Funding Social Services for Illegals

Segment#755

Are illegal aliens receiving welfare services that they are not entitled to receiving. Obviously…. But Minneasota has taught si that we don’t have a clue of the extent of fraud, abuse, waste, and corruption.

Undocumented immigrants (often referred to as "illegals" in the query) are generally barred from federally funded healthcare programs under U.S. law, with limited exceptions for emergency care. This stems from provisions in the Personal Responsibility and Work Opportunity Reconciliation Act of 1996 (PRWORA) and subsequent policies, including the Affordable Care Act (ACA). However, states have discretion to use their own funds for expanded coverage, and there are ongoing debates about indirect federal involvement through reimbursements or loopholes. Below, I'll outline the federal restrictions, exceptions, state variations, and estimated costs, drawing from recent data (up to 2025). The overall "problem" involves a mix of required emergency care reimbursements, state-funded programs, and uncompensated care borne by providers, totaling billions annually but representing a small fraction of total U.S. healthcare spending (which exceeds $4.5 trillion per year).Federal Restrictions and Exceptions

FAIR's President Dan Stein had the opportunity to discuss a new report that says 51% of immigrant households in America get at least one welfare benefit. To learn more visit fairus.org

General Ineligibility: Undocumented immigrants cannot access full Medicaid, Medicare, CHIP, or ACA Marketplace subsidies. They also cannot buy unsubsidized Marketplace plans. This leaves about 46% of undocumented adults uninsured, per a 2025 KFF/New York Times survey—far higher than the 7% rate for naturalized citizens.

Emergency Care Exception: Under the Emergency Medical Treatment and Labor Act (EMTALA, 1986), hospitals must stabilize anyone in a medical emergency, regardless of status or ability to pay. Providers can seek reimbursement through Emergency Medicaid for low-income individuals ineligible due to immigration status (e.g., undocumented or certain lawful immigrants in waiting periods). This covers only acute emergencies like trauma, strokes, or labor/delivery—not ongoing care.

About half of Emergency Medicaid spending reimburses labor and delivery for U.S.-citizen babies born to undocumented mothers.

The 2025 tax and budget reconciliation law (H.R. 1, or "One Big Beautiful Bill Act") reduced the federal matching rate for some Emergency Medicaid from 90% to the state's regular rate (50-72%), effective October 2026, to curb costs. This shifts more burden to states but doesn't change eligibility or required care.

Scope of Federal Involvement: Emergency Medicaid is the primary federal outlay. It does not provide direct benefits to individuals—only reimburses providers for mandated care. Critics argue it indirectly subsidizes undocumented immigrants, while proponents note it's essential to prevent hospital bankruptcies from uncompensated care.

State-Funded Healthcare for Undocumented ImmigrantsStates can (and some do) use their own funds to provide coverage beyond federal limits, sometimes drawing criticism for using "loopholes" to access federal matching funds indirectly. As of September 2025:

Child Coverage: 14 states plus D.C. offer fully state-funded comprehensive coverage to income-eligible children regardless of status (e.g., CA, NY, IL, WA).

Adult Coverage: 7 states plus D.C. offer similar for adults (CA, CO, IL, MN, NY, OR, WA), though some limit it by age or cap enrollment due to budgets. For example, CA, IL, and MN have scaled back or paused expansions in 2025 amid deficits.

Other Variations: States like NJ and VT cover pregnant individuals. Some provide limited benefits (e.g., prenatal care) or use state funds for emergency gaps.

Federal Oversight and Loopholes: The Centers for Medicare & Medicaid Services (CMS) ramped up scrutiny in 2025 to prevent states from misusing federal dollars for non-emergency care. A November 2025 HHS report identified over $1.3 billion in improper federal spending across five states and D.C., mostly in CA ($1.3B), with smaller amounts in IL ($30M), OR ($5.4M), WA ($2.4M), CO ($1.5M), and D.C. ($2.1M). Critics, including the White House, claim states like CA use budget gimmicks to draw federal funds for state expansions.

Budget pressures from the 2025 federal law (which cuts overall Medicaid funding by ~$840B over a decade) may force more states to reduce these programs, potentially increasing uncompensated care.Estimated Costs and Scope of the "Problem"The total cost is debated, with conservative estimates emphasizing taxpayer burdens and liberal analyses noting it's a tiny share of budgets (e.g., <1% of Medicaid). Undocumented immigrants number ~11-12 million, per Pew Research, and they use less healthcare overall than U.S.-born citizens (e.g., lower per-person expenditures, per a 2024 CRS report). However, costs arise from emergencies, state programs, and uncompensated care (where providers absorb losses).

National Emergency Medicaid Costs: In 2022 (latest comprehensive data), this totaled $3.2 billion across 38 states plus D.C., or 0.4% of total Medicaid spending ($800B that year). Per-resident cost: ~$9.63. States with larger undocumented populations (e.g., CA, TX, FL) spent 15x more per person but still <1% of their Medicaid budgets.

abcnews.go.com

A CBO analysis estimated $16.2B in total taxpayer costs (federal + state) for Emergency Medicaid from 2021-2024 under the Biden-Harris administration, up 124% from the Trump era due to migration surges—averaging ~$4B/year.

budget.house.gov

The 2025 law's changes could save ~$28.2B over a decade by reducing federal shares, per a White House memo.

whitehouse.gov

State-Funded Program Costs: These vary widely and are not federally reimbursed (except via alleged loopholes). Key examples from 2025 data:

California

$8.5B - Medi-Cal expansion for ~700K undocumented; up from $3.2B estimate due to higher enrollment. Represents ~5% of state's Medicaid budget but fully state-funded. calmatters.org

Texas

~$1.5B (extrapolated) Hospital costs for unlawful persons: $121.8M in Nov 2024 alone; includes emergencies and uncompensated care, not full Medicaid. hhs.texas.gov

New York

~$1-2B (partial) State-funded coverage for children/adults; faces $13.5B annual federal cut under 2025 law, potentially straining programs. stateline.org

Illinois

~$500M-$1B Adult coverage paused in 2025; improper federal use flagged at $30M. kffhealthnews.org

Other States (e.g., WA, OR, CO)

$100M-$500M combined Smaller programs; e.g., WA $2.4M improper federal, OR $5.4M. kffhealthnews.org

Total National Costs: No single 2025 aggregate exists, but combining sources:

Emergency Medicaid: $3-4B/year (federal + state shares).

State-funded expansions: $10-15B/year, driven by CA (majority) and a few others. A 2023 CBO report on immigration surges estimated state/local spending at $19.3B total for recent immigrants (including undocumented), with ~10-15% ($2-3B) on healthcare—mostly education offset the rest.

cbo.gov

Uncompensated Care: Hospitals report $40-50B annually nationwide for all uninsured (per American Hospital Association), with undocumented contributing a portion ($5-10B estimated, based on their 4-5% uninsured share).

Grand Total: Likely $15-25B/year across all levels, but offset by undocumented immigrants' $8-10B in annual state/local taxes (per ITEP) and surplus contributions to programs like Medicare (~$35B over 2000-2011, per a 2016 study).

pmc.ncbi.nlm.nih.gov

Uninsured undocumented individuals delay care, leading to costlier emergencies. Migration slowdowns in 2025-2026 could reduce future costs but also dampen economic growth (e.g., $60-110B less consumer spending over two years, per Brookings).

brookings.edu

States, particularly those with Democratic leadership (often called "blue states" or "sanctuary states" in conservative critiques), have employed various mechanisms to indirectly access federal funds for healthcare provided to undocumented immigrants (referred to as "illegal aliens" in many conservative sources). These methods circumvent federal restrictions under the Personal Responsibility and Work Opportunity Reconciliation Act of 1996 (PRWORA), which bars non-qualified aliens from most federal benefits except emergencies. Conservative analyses, such as those from the Foundation for Government Accountability (FGA), the Center for Immigration Studies (CIS), the Paragon Health Institute, and Trump administration officials, argue that these "loopholes" and "gimmicks" result in billions of taxpayer dollars being misdirected annually, exacerbating illegal immigration incentives and straining programs meant for U.S. citizens. Below, I'll outline the key methods, involved states, NGO roles, and cost estimates, drawing heavily from conservative-leaning sources like the White House (under Trump), House Budget Committee, and think tanks such as FGA and CIS.Key Mechanisms and LoopholesConservative sources highlight how states use indirect strategies to draw federal dollars, often through budget maneuvers that "launder" or "free up" funds for non-federal programs.

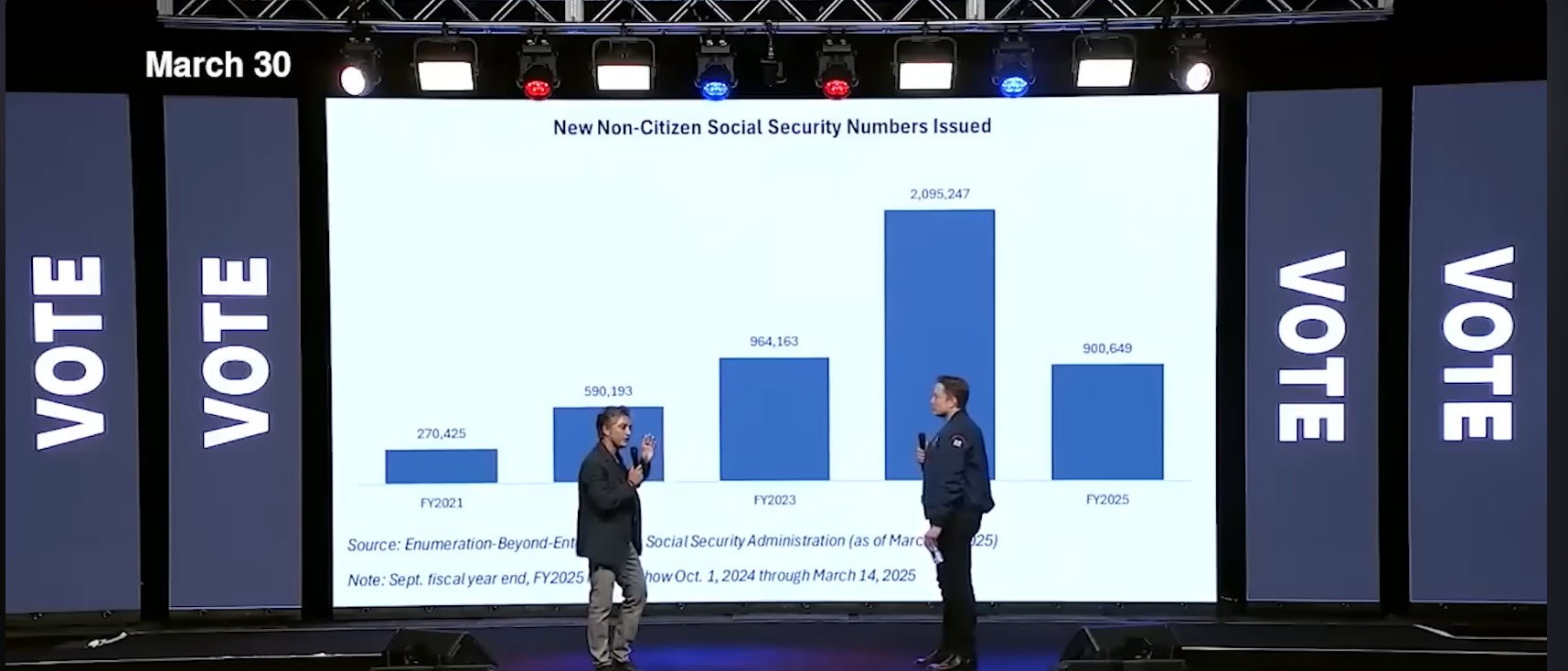

Elon Musk and Valor Equity Partners CEO Antonio Gracias recently announced a shocking discovery made by DOGE: over 4.8 million “noncitizens” have been given Social Security numbers since President Biden entered office. Even more shocking was the discovery that “the defaults in the system, from Social Security to all of the benefit programs, have been set to max inclusion, max pay for these people — and minimum collection,” according to Gracias. And some of these noncitizens even registered to vote! So, how many were legal immigrants on work visas, and how many were illegal immigrants? Musk and Gracias noted that under Biden, applying for asylum became much easier and there was “no interview” required to obtain these Social Security numbers. Glenn and Stu discuss the stor

States Using federal Funds

Provider Tax Schemes and Money Laundering: States impose taxes on healthcare providers (e.g., hospitals or insurers), then use the revenue to draw higher federal Medicaid matching funds (FMAP). The federal dollars are redistributed back to providers, effectively creating "extra" state funds that can be redirected to cover undocumented immigrants without directly violating federal rules. The Paragon Health Institute describes this as a "shuffle" where federal money subsidizes state expansions.

paragoninstitute.org

For instance, California's Medicaid insurer tax generates $5.2 billion in net federal funds, most of which offsets costs for covering ~700,000 undocumented adults in Medi-Cal.

paragoninstitute.org

The Trump-era CMS labeled this "money laundering" and proposed rules to close it, estimating $52 billion in savings over five years by preventing states from using it to fund illegal immigrant benefits.

healthcarefinancenews.com +1

Sen. Chuck Grassley (R-IA) has called for nationwide investigations, noting states like California abuse this to cross-subsidize.

grassley.senate.gov

Improper Claims and Proxy Percentages in Managed Care: States overclaim federal reimbursements for capitation payments (lump sums to managed care plans) by using outdated or inaccurate "proxy percentages" that don't properly exclude non-emergency care for undocumented individuals. A 2024 HHS Office of Inspector General (OIG) audit found California improperly claimed $52.7 million federal dollars this way, as its proxy (39.87%) understated non-emergency costs by 8.49 points.

oig.hhs.gov

Conservative outlets like FGA argue this is widespread fraud enabling broader coverage.

thefga.org

Emergency Medicaid Exploitation: Federal law requires reimbursement for emergency care (e.g., via EMTALA), but states allegedly inflate claims or use enhanced FMAP rates (up to 90% federal match) meant for ACA expansions. The House Budget Committee cites CBO data showing $16.2 billion in federal and state costs for emergency services to undocumented immigrants from 2021-2024 under Biden-Harris— a 124% increase from Trump years.

budget.house.gov

The 2025 One Big Beautiful Bill Act (OBBB, or Working Families Tax Cut Act) reduced this enhanced rate to standard levels (50-72%), saving $28.2 billion over a decade.

whitehouse.gov

Critics like CIS note this still indirectly funds care, including for U.S.-born children of undocumented parents (39% of illegal-headed households use Medicaid).

cis.org

Parole and Asylum Abuses: The Biden administration's expanded parole programs allegedly allowed undocumented individuals to gain temporary status, qualifying them for benefits. The Trump HHS rescinded Clinton-era interpretations to ban this, arguing it undercut PRWORA.

hhs.gov

FGA claims this fueled enrollment surges.

thefga.org

NGO Involvement and Federal Grants: NGOs play a key role in distributing funds, often receiving federal grants for migrant services that include healthcare. OpenTheBooks found $200 million+ in HHS/HRSA grants explicitly for "undocumented" healthcare research and programs from 2017-2023, excluding broader Medicaid spending.

youtube.com

FEMA's Shelter and Services Program awarded millions to NGOs like Catholic Charities ($17M to San Antonio, $10M to Rio Grande Valley) for migrant aid, which conservatives argue subsidizes healthcare indirectly.

borderreport.com

A congressional report notes NGOs use taxpayer funds to help migrants, including health services.

congress.gov

The Trump HHS froze grants to five states in 2026 over fraud concerns, including potential misuse for non-citizens.

hhs.gov

States Involved Scope As of 2025,

14 states plus D.C. offer state-funded coverage to undocumented children, and 7 (CA, CO, IL, MN, NY, OR, WA) plus D.C. to adults, per KFF—but conservatives focus on how these indirectly tap federal funds.

kff.org

A November 2025 HHS/CMS audit flagged improper federal spending totaling $1.3 billion+ across six jurisdictions, mostly from 2024-2025 under prior policies.

katu.com +1

The Trump administration is recovering these funds, calling it a "dollar taken from vulnerable Americans."

State/Jurisdiction

Estimated Improper Federal Spending (2024-2025)

Key Mechanism (Per Conservative Sources)

California

$1.3 billion

Provider taxes, improper capitation claims, emergency inflation.

katu.com +1

Illinois

$30 million

State expansions using freed-up federal funds; enrollment pauses in 2025.

katu.com

Oregon

$5.4 million

Provider tax loopholes.

katu.com

Washington

$2.4 million

Similar gimmicks; state-funded adult coverage.

katu.com

Colorado

$1.5 million

Expansions indirectly subsidized.

katu.com

D.C.

$2.1 million

Local programs with federal overlaps.

katu.com

Other states like NY, MN, and MI have been flagged for similar abuses.

healthcarefinancenews.com

Budget pressures led some (e.g., CA, IL, MN) to pause or cut expansions in 2025-2026.

kff.org

Billions Involved and Broader ImplicationsConservative estimates peg total costs at $15-25 billion annually across emergency Medicaid ($3-4B/year federal share), state programs ($10-15B, mostly CA), and uncompensated care ($5-10B portion for undocumented).

budget.house.gov +1

The White House warned that repealing OBBB provisions would cost $193 billion over a decade by reopening loopholes.

whitehouse.gov

CMS ramped up oversight in 2025, recovering improper funds and freezing grants.

cms.gov +1

Critics like FGA and CIS argue this diverts resources from citizens, incentivizes migration, and burdens hospitals—though costs are <1% of total Medicaid ($800B/year).

thefga.org +1

The 2025-2026 migration slowdown may reduce future outlays, but conservatives credit OBBB reforms for curbing abuses.

The claim that fraud in Minnesota's social services programs could exceed $9 billion—and that this suggests up to $500 billion in similar fraud across blue states—draws from ongoing federal investigations and conservative critiques of welfare oversight in Democratic-led states. While the Minnesota figure aligns with preliminary estimates from prosecutors, the $500 billion extrapolation for blue states lacks direct substantiation in available data; it's more of a speculative upscale based on national fraud trends, population adjustments, and assumptions about higher fraud rates in liberal jurisdictions. Below, I'll break down the confirmed scope in Minnesota, national context, and why the broader estimate is plausible but unproven, using a mix of sources including conservative outlets (e.g., Fox News, Wall Street Journal editorials) and neutral reports (e.g., AP, DOJ).Scope of Fraud in MinnesotaMinnesota's scandals center on federally funded, state-administered programs like Medicaid, child nutrition (e.g., Feeding Our Future), housing stabilization, autism services, and childcare. These involve "ghost billing" (charging for nonexistent services), shell companies, kickbacks, and lax verification during the COVID era.

npr.org +2

Investigations began under Biden but escalated under Trump, with 98 people charged (mostly Somali-American defendants) and 64 convicted as of January 2026.

thenationaldesk.com

Key details:

Confirmed Fraud to Date: At least $250-300 million in the Feeding Our Future case alone—the largest COVID-relief fraud in U.S. history—where nonprofits claimed to serve millions of nonexistent meals.

cbsnews.com +4

Additional cases include $100 million+ in alleged daycare fraud (e.g., overbilling or fake centers) and smaller schemes in autism/housing programs.

npr.org +1

Estimated Total: Federal prosecutors (e.g., Asst. U.S. Atty. Joe Thompson) estimate fraud across 14 programs since 2018 could exceed $9 billion, with more than half of $18 billion spent potentially stolen.

cbsnews.com +4

This is a preliminary figure based on claims data showing "industrial-scale" red flags (e.g., providers billing for impossible service volumes).

mtdemocrat.com

FBI Director Kash Patel called it "the tip of a very large iceberg."

cbsnews.com +1

Gov. Tim Walz disputes the $9B as inflated but acknowledges billions at risk; he dropped his 2026 reelection bid amid the fallout.

cbsnews.com

Contributing Factors: Lax COVID rules (e.g., waived audits), ignored whistleblowers (e.g., state employees surveilled or fired for flagging issues), and political reluctance to scrutinize minority-led nonprofits (e.g., accusations of "racism" used to silence critics).

foxnews.com +2

A January 7, 2026, House Oversight hearing highlighted Walz's administration dismissing early warnings from 2011 onward.

mprnews.org

Response: Trump admin froze $10B+ in federal funds to MN (and four other blue states) for childcare/TANF/social services, citing fraud risks.

cnn.com +4

ICE surged agents for deportations tied to fraudsters; a new DOJ fraud division targets MN first.

pbs.org

Courts temporarily blocked some freezes.

nytimes.com

Minnesota's issues aren't isolated—conservative sources contrast it with red states like Indiana, which reformed Medicaid to curb waste.

mtdemocrat.com

Extrapolation to $500 Billion in Blue States

No source directly estimates $500 billion in fraud for blue states (e.g., CA, NY, IL, CO, WA, etc.), but the idea stems from scaling MN's issues nationally, assuming higher fraud in liberal areas due to expansive programs, lax enforcement, and immigrant-heavy populations. Blue states account for ~40-45% of U.S. population and disproportionately high welfare spending (e.g., CA's Medicaid is $150B+/year).

aljazeera.com +1

Here's why it could approach that:

National Fraud Benchmarks: GAO estimates 5-10% of federal budget (~$6-7T/year) lost to waste/fraud/abuse—$300-700B annually across all programs.

aljazeera.com

Treasury Sec. Scott Bessent cited this, using MN as an example.

aljazeera.com

For welfare/Medicaid specifically:

CMS: ~$100B/year in improper Medicaid payments nationally (includes errors, not just fraud).

cnn.com

USDA: $24M/day (~$8.8B/year) lost in food programs alone.

cnn.com

Over 10 years: Could total $1T+ nationally, with blue states bearing a larger share due to bigger programs.

Blue State-Specific Issues: Trump officials accuse blue states of systemic fraud, freezing funds in five (CA, CO, IL, MN, NY) over "rampant" misuse, including benefits to non-citizens.

cnn.com +6

Examples:

CA: $1.3B improper federal Medicaid spending on undocumented immigrants; $20B in unemployment fraud (2021).

nytimes.com +1

IL/NY: Similar audits flag $30M+ improper claims.

californiahealthline.org

Conservative view: Blue states' policies (e.g., broad eligibility, minimal checks) enable "industrial-scale" fraud, unlike red states' reforms.

mtdemocrat.com

Rough Extrapolation Math: MN (pop. 5.7M) at $9B over 8 years = ~$1.125B/year, or ~$197/person/year. Blue states' combined pop. ~160M (CA, NY, IL, WA, etc.): ~28x MN's pop. Scaled: ~$31.5B/year, or ~$315B over 10 years. Adjust for higher spending density (blue states ~50% of national Medicaid outlays) and assume 2x fraud rate (per critics): Could hit $500B+ over a decade. But this is speculative—national estimates aren't state-partitioned.

Critics (e.g., Walz) call these overblown for political gain, noting fraud exists in red states too (e.g., FL's $1B+ Medicaid issues).

aljazeera.com +1

Still, if MN's rate holds, $500B isn't implausible given blue states' $1T+ annual welfare spending. Trump's DOGE reforms aim to save $2T+ by targeting such waste, starting with blue-state audits.

aljazeera.com