What Are Welfare Social Services in the US?

Segment #761

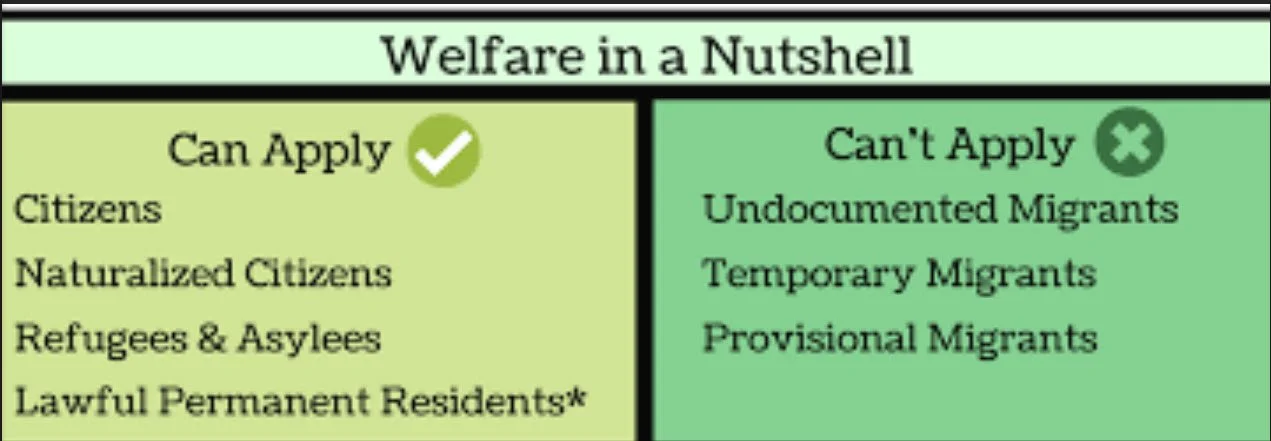

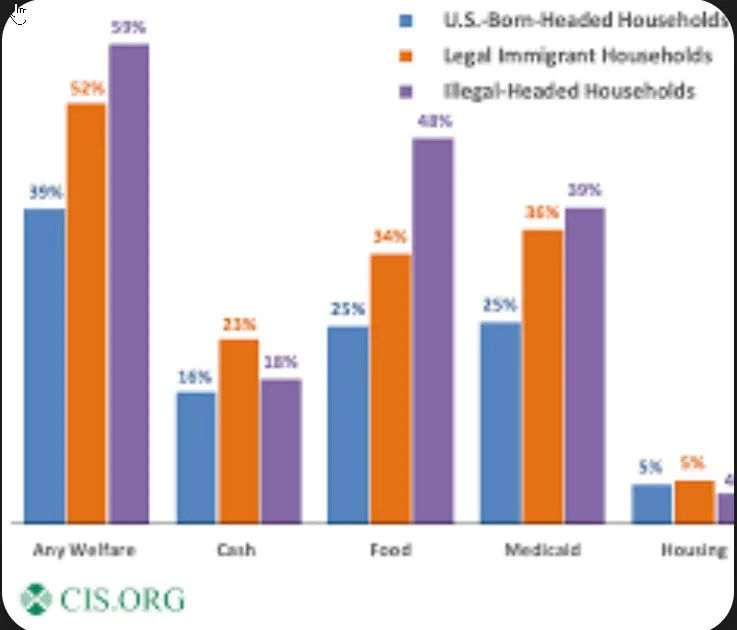

Undocumented immigrants (often referred to as illegal migrants) are generally ineligible for most federal welfare and social services under the Personal Responsibility and Work Opportunity Reconciliation Act (PRWORA) of 1996 and related laws, which restrict access based on immigration status. false documentation, loopholes in emergency or state-funded programs, or indirect benefits for U.S. citizen children in mixed-status households. Reports from organizations like the Center for Immigration Studies (CIS) estimate high usage rates (e.g., 59% of undocumented-headed households using at least one major program), often via citizen children or fraud, though critics argue these figures overlook net contributions (e.g., billions in payroll taxes to Social Security and Medicare without benefit receipt).

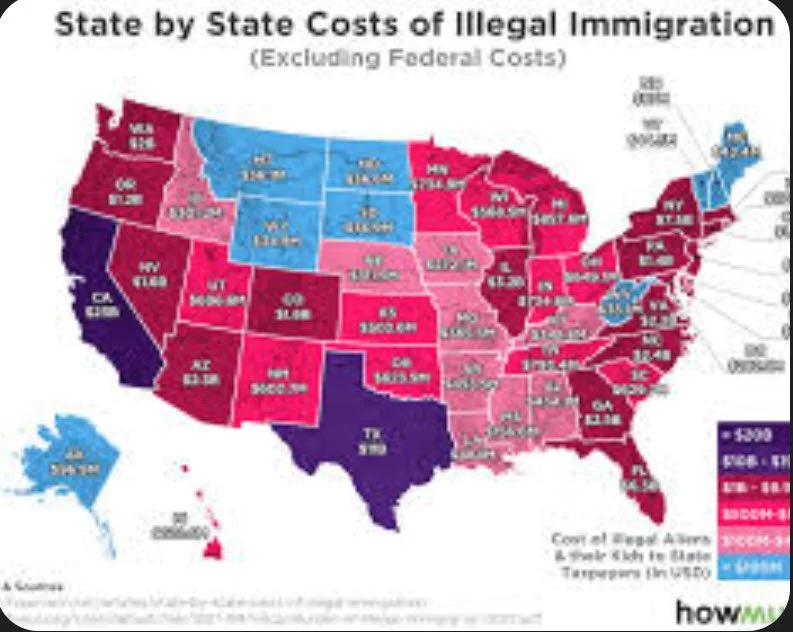

Fraud is facilitated by weak verification in some states, leading to improper claims totaling millions (e.g., $52.7 million in California Medicaid audits). Below is an expanded, comprehensive overview of key areas, drawing from government audits, think tank reports, and investigations. This includes deeper details on mechanisms like identity fraud and program loopholes, plus additional areas such as tax credits, education, and community health services.

SNAP (Supplemental Nutrition Assistance Program) and Related Food Aid

Undocumented are ineligible, but fraud involves identity theft (e.g., stolen EBT cards or SSNs), trafficking benefits, or indirect access via citizen children where benefits are prorated but misused by adults. Loopholes during crises (e.g., government shutdowns) allow scams like early redemptions. CIS estimates 50% of non-citizen households with children use food welfare; cases include $7M+ scams. USDA has blocked illegal access, but critics claim states like NY enable it. Overall fraud: 1-2% of $100B+ program, with immigrants contributing via sales taxes. Includes school meals (NSLP) for undocumented children, seen as indirect fraud by some.

Medicaid, Obamacare, and Healthcare Programs (incl. CHWs)

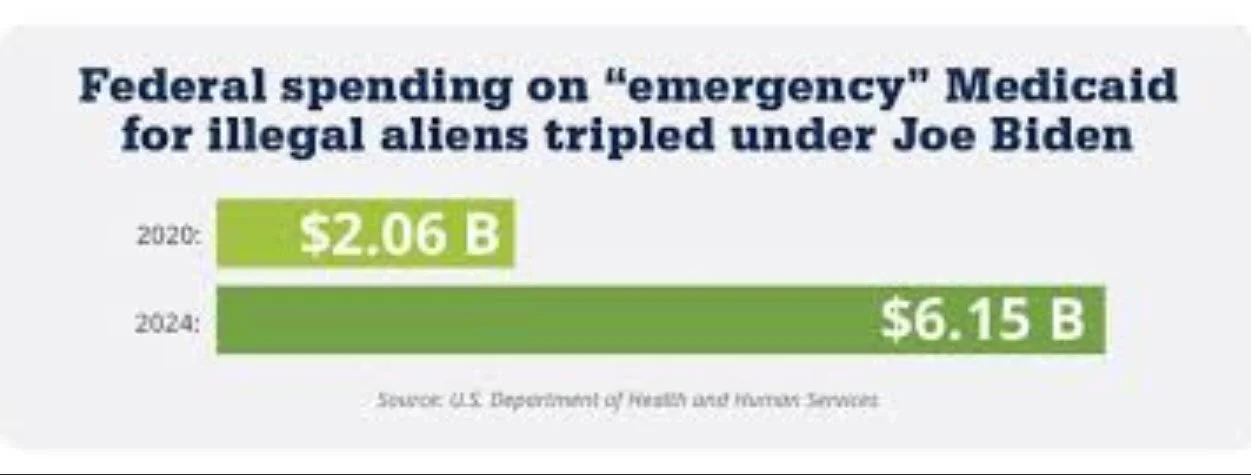

Barred from full federal coverage, but fraud via stolen identities, "reasonable opportunity" periods (temporary access without verification), overuse of Emergency Medicaid (EMTALA-funded for urgent care), or state expansions using federal loopholes. CHWs facilitate fraudulent enrollments by aiding false claims or navigating gimmicks. $52.7M improper claims in CA; $6.1B federal EM spending in 2024, with non-emergency misuse. States like CA cover 1M+ undocumented via expansions, costing billions. Undocumented add $25B+ to Medicare annually without benefits. CHW fraud includes fake health docs in trafficking rings.

Regarding "CHOW (Community Health Organization Workers)": This appears to refer to Community Health Workers (CHWs), also known as Community Health Outreach Workers or Promotores de Salud in immigrant communities. CHWs assist with health education, enrollment in programs like Medicaid, and navigation of services, sometimes leading to fraud allegations if they help undocumented individuals exploit loopholes (e.g., false status claims or over-enrollment in state-funded health initiatives). Investigations have linked CHWs to corruption in facilitating fraudulent health documents or improper access, particularly in smuggling/trafficking contexts where fake certificates enable illegal entry or work. For instance, in Southeast Asia and U.S. border regions, CHWs have been implicated in schemes involving fraudulent health clearances for migrants. In the U.S., programs like state-funded CHW initiatives (e.g., in California or New York) face scrutiny for potentially enabling undocumented access to non-federal health supports without rigorous status checks.

Housing Assistance (e.g., Section 8, Public Housing, Homeless Aid)

Federal bans, but fraud through fake IDs, stolen identities, or prorated aid in mixed households. State/local programs (e.g., vouchers) have lax checks, enabling access. Multimillion-dollar schemes in LA homeless programs; prioritization claims in NY/CA over citizens. HUD crackdowns include reporting hotlines; net drain estimated at $10B+ annually for immigrant households.

TANF (Temporary Assistance for Needy Families) and Cash Welfare

Restricted, but indirect fraud for citizen children or via false status. State variations allow access; overpayments from weak verification. 59% use in undocumented households; prosecutions rare but include perjury charges with immigration consequences.

Social Security Benefits and Related

Cannot receive, but fraud via stolen SSNs for wage claims or rare benefit access. Contribute $25.7B in 2022 via payroll, with $2T in mismatched wages historically. ICE operations uncover 100+ identity theft victims; deportation worsens SS solvency. Fraud destroys lives of U.S. children via stolen identities.

Tax Credits (e.g., EITC, CTC)

Undocumented use ITINs for filing, accessing refunds/credits for citizen children. Seen as fraud if tied to false wages or identities. High use (mainly EITC) in illegal households; IRS blocks some, but billions paid out. Critics call it "special tax benefits" for fraudsters.

Child Care Subsidies (e.g., CCDF) and WIC

Ineligible directly, but fraud via false docs or indirect for children. State programs vary; weak checks in enrollment. MN probes reveal verification risks; WIC used by half of non-citizen families with kids, regardless of status.

Unemployment Insurance

State-run; ineligible, but fraud via stolen identities or false authorization during pandemics. Spikes in claims; prosecutions for falsified docs, especially in CA/TX.

Energy Assistance (e.g., LIHEAP) and Utilities Aid

Restricted federally, but state loopholes or false residency claims enable access; emergency aid lacks status checks. Low fraud data, but included in broader welfare drain estimates.

Education Benefits (K-12, In-State Tuition, Aid)

Free K-12 mandated (Plyler v. Doe), seen as indirect subsidy; fraud in higher ed via false residency for tuition/aid in 20+ states. Costs $150B+ annually for immigrant children; DREAMer aid in states like CA accused of fraud via lax verification.

Other Emergency/Community Services (e.g., Behavioral Health, Refugee Aid Misuse)

Undocumented immigrants are not authorized for major federal welfare programs like SNAP, TANF, full Medicaid/CHIP, SSI, federal housing vouchers, unemployment insurance, or tax credits like the Earned Income Tax Credit (EITC) or Child Tax Credit in most cases (though ITIN filers may claim some for citizen dependents, with restrictions).

They contribute significantly to systems like Social Security and Medicare via payroll taxes (often using ITINs or mismatched SSNs) but cannot receive benefits from them.

Any broader access typically comes from state-funded programs (e.g., state-only Medicaid expansions in places like California or New York), which may use state dollars to cover undocumented individuals — these are not federal benefits.

How States Avoid Restrictions on Illegal Aliens Receiving Social Serices Paid with Federal Funds

Indirect access via U.S.-born children: Undocumented parents apply for benefits (e.g., SNAP, Medicaid) on behalf of citizen children, effectively supporting the household. Federal reimbursements flow to states for these eligible members, but conservatives view this as a loophole subsidizing the undocumented adults.

Emergency Medicaid overuse: Federal matching funds (FMAP) reimburse states for "emergency" care to undocumented individuals, but sources claim states broadly interpret "emergency" (e.g., including routine births or chronic conditions), leading to billions in federal spending.

Provider tax "money laundering" schemes: States like California impose taxes on healthcare providers, receive enhanced federal Medicaid matches on those taxes (up to 6:1 ratios), then redirect the funds to cover undocumented care—effectively using federal dollars indirectly. A 2025 federal audit flagged $52.7 million in improper California claims.

State-funded expansions with federal offsets: States create "state-only" programs for undocumented (e.g., full Medicaid in California for 1M+ individuals), but use federal reimbursements from other areas to offset costs, or exploit waivers/loopholes to blend funds.

Weak enforcement and improper claims: Lax federal oversight allows states to claim reimbursements for ineligible services; conservatives cite ignored 1996 laws requiring sponsors to repay benefits.

Other programs: Federal funds for education (K-12), WIC, or disaster aid flow to states without strict status checks, benefiting undocumented.